According to tech guru Nick Macario, what’s powering Bitcoin-mania may soon disrupt Recruiting, by toppling Facebook and LinkedIn and returning ownership to individuals.

On February 5, 1637, the children of Dutch tavern-keeper, Wouter Bartelmiesz, gathered their late father’s possessions for a large auction in the town of Alkmaar. Among items up for bid was a small botanical collection that drew both the humble townsfolk and wealthy elite into the auction house. For many, the public event was pure spectacle. For the crafty, there were particular items promising outlandish, unprecedented wealth: tulip bulbs.

Newly introduced from Turkey to the Netherlands in the late 1500s, tulips became the day’s hottest industry. A poet at the time wrote of the Dutch tulip trade, “He who considers the profits that some make every year from their tulips will believe that there is no better Alchemy than this agriculture.”

Highly valued for their novel rarity, tulip bulbs were in high demand, encouraging many nascent investors to liquidate their assets and get on board with the lucrative but risky venture. Tulip prices swelled when certain specimens mutated, following an outbreak of the non-fatal mosaic virus that left irregular color patterns on petals. Garden centers around the lowlands scrambled to keep these rare flowers in stock, and between December 1636 and January 1637, their price increased twenty-fold. Speculation as to how much higher prices could go was rife. Tulips became a futures market.

At the Alkmaar auction, one buyer paid 21,000 guilders for a single lot. Enough to buy two large houses on Amsterdam’s swishiest waterway, the Keizersgracht, or Emperor’s Canal (where today, one floor of one of those canal houses easily goes for a million euros). In the span of a few hours, Wouter Bartelmiesz’s children went from poor orphans to exceptionally wealthy thanks to their late father’s collections, and just in time, too, as the tulip supply, racing to meet demand, soon began to outpace it.

A matter of weeks after the auction, determined sellers were flooding the market, creating a domino effect of lower and lower prices that sent many remorseful buyers into a panic, and any remaining prospectors running for the dunes. In a pattern that has played out several times since, with few takers and an oversaturated supply, the market imploded. So badly that the federal government was forced to intervene, mediate, and settle disputes.

“Tulip mania” is generally considered to be the first speculative bubble in modern Western history. Today, many consider investing in Bitcoin to be the latest.

The current controversy around the world’s most well-known cryptocurrency shares “many of the elements of tulip-bulb mania,” said Citadel CEO Ken Griffin, remarking on the record price of nearly $20,000 a coin in late 2017. Value dropped dramatically between December 2017 and February 2018, and despite a slight increase in March of this year, current price trackers illustrate a diminishing trend.

“All the speculation between cryptocurrency prices cause people to ultimately question how there’s no physical object backing the value,” says Nick Macario, co-founder of dock.io and CEO of Remote.com.

While the risks of investing in commodities like gold and silver — to say nothing of tulip bulbs — are well known, Macario identifies an important distinction: “People accepted gold as the currency standard because it’s a physical object. They feel there’s an explanation for why gold can have a value. However, that worth is disconnected from its utility as gold.”

To adrenaline-jacked trader types, it doesn’t matter. To the skeptical or the parsimonious, unseasoned newcomers are investing in technology few can even explain. At least with tulips, everyone agreed that they were beautiful flowers worthy of admiration. What Bitcoin is, the nuts and bolts that make it work, are almost too abstract to explain fully here. So we won’t. Not just yet.

That’s where futurists like Macario come in. A serial founder who’s launched four companies and honorably exited two, he’s here to demystify the technology powering Bitcoin-mania, the bulb of the thing, if you will. It’s called blockchain, and “it’s sometimes referred to as a pyramid scheme,” says Macario. “There’s a lot of mistrust because many people don’t, fundamentally, understand it. Blockchain technology is not only for cryptocurrency, although that’s the most widely used application for it.”

Macario is using blockchain to power his most recent venture, dock.io, launched this year, which connects millions of job seekers on a decentralized network, one he says will rival Facebook and LinkedIn, only without limitations to user-data mobility.

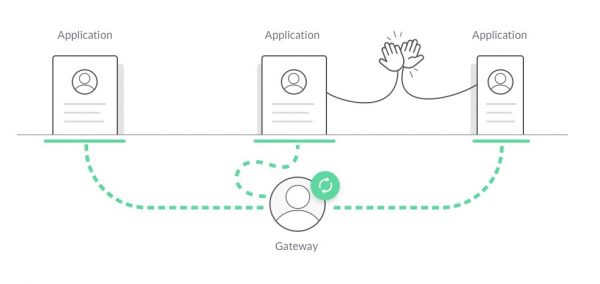

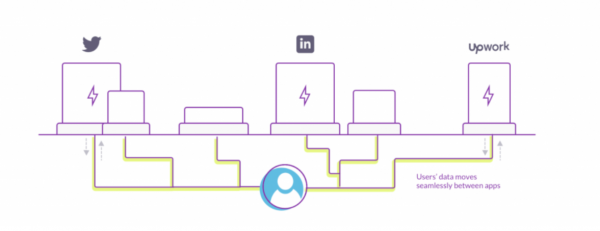

The way things work now, professionals build extensive profiles, reputations, and experiences on closed business and social networking platforms like Facebook, Reddit, LinkedIn, even Twitter. But what happens when you decide to shift your personal information onto another network? It can’t be done.

Macario insists blockchain holds huge potential beyond cryptocurrency or freeing your data from Facebook. Macario insists, perhaps unexpectedly, that blockchain is about to disrupt the recruitment industry.

Imagine: when you update your profile with a new job title, it automatically syncs and updates everywhere at once, across all platforms, saving you time and optimizing your online processes. dock.io also expedites recruiters’ manual tasks like conducting background checks. For candidates, deciding which applications can access your data is as simple as toggling notifications on or off.

“We’re empowering the user tremendously,” says Macario. “We’re going to build the largest, most complete resource of data about an individual in existence.”

Given the current climate of massive data leaks and growing concerns over the sale of browsing histories to advertisers, Macario’s claims of freely sharing profiles across the net may sound undesirable, but the ledger records on the blockchain are both continually updated across the peer-to-peer network, and protected by a layer of cryptography distributed across many points, or “nodes”. Any unauthorized changes would require massive amounts of computing power to access the controlling majority (at least 51%) of nodes, and modify them simultaneously. The bigger the network, the more difficult this becomes.

Though the dock.io network may still be in its infancy, it’s scaling rapidly and gaining buzz. This February, dock.io completed its Initial Coin Offering (ICO) — the cryptoquivalent of an IPO — raking in over $20m via DOCK token sales. These tokens decide how data is accessed and shared across the dock.io protocol. Transactions of data exchange between applications and users on dock.io incur a token cost. This token exchange also works to ensure the quality of data, as applications are only rewarded tokens when other applications validate the same data on their networks. DOCK tokensalso grant the holder influential votes over the future direction of the protocol as dock.io scales up in the coming months, much like a shareholder in a traditional company structure.

“We could create a powerful network that helps applicant tracking systems and other CRM systems,” says Macario, “because they have more enriched data to build more and better features, recruit better, and make better decisions.”

*****

Like other blockchain acolytes, Macario’s exhortations bear the burden of public proof. But Macario knows that even when broken down into its most basic elements, blockchain theory is about as punchy as reading a Samsung TV instruction manual. In Korean. But this is tech that may change your life sooner than you think, so let’s try.

A blockchain is an encrypted digital ledger of records, organized into blocks. These blocks are located on servers called nodes, with any nodal computer connected to the network and linked to others, like a chain. Each node maintains a copy of said ledger and informs other nodes of newly submitted or newly verified transactions, allowing information to be distributed securely across an entire network without the need for a central administrator. This is possible because blockchain transactions contain their own proof of validity and authorization, instead of requiring a centralized application.

Blockchain’s distributed database syncs data along all nodes in the chain and protects them with advanced cryptography, meaning that all data on the chain is transparent and immutable. By nature of its decentralized network, the blockchain is extremely difficult to hack, and global enterprises including Walmart, FedEx, UPS, British Airways, and Dutch transport company Maersk, use blockchain to track supply chains, streamline and secure international shipping, solve customer disputes, and standardize global trade and finance.

Even non-profits, fashion gurus, and musicians are integrating blockchain into their business practices. Great for Macario and his cause, likely awesome for recruiting; not so good for anyone waiting for the next Kanye single to leak.

For job seekers, blockchain’s value is clear. They own their data and can share it wherever and with whomever they please, on a secure, verifiable, and decentralized network. After the hiring process, blockchain can protect employee data from falsification and unauthorized changes, since the data can only be modified with the approval of all links in the chain.

“Instead of controlling user data,” Macario suggests, “companies will realize that their model is creating a better network and a better offering. People can freely decide to use their platform, not because they are trapped there.“ Though Macario assures his end goal is to work with large platforms, he confidently claims, “We don’t need Facebook or LinkedIn to grow a huge network.”

Through direct signups, the dock.io network grows by 100k new users each month. Not much compared to Facebook’s 2.2 billion or LinkedIn’s 500 million last quarter, but “where we start to scale is through partnerships with companies like SmartRecruiters,” says Macario. “There are 12 million job seekers a year who are not yet in the dock.io network. When we start integrating them, and then plug into hundreds of other networks, we can scale to build a bigger network than LinkedIn, and do it without LinkedIn.”

Though the balance of internet power could fluctuate in the wake of upcoming data privacy legislation, both in the US and abroad, until data control returns to the hands of individuals, Macario won’t be happy, and we won’t necessarily be safe. But dock.io looks to be instrumental in moving the needle towards empowering individuals world-web-wide and debasing the systems of power that give companies like Facebook enough control to keep a scandal like Cambridge Analytica out of the press for so long.

So as long Bitcoin and others like it remain more an abstraction than something to pay for your groceries with, the cryptocurrency market will remain unstable. But instead of fixating on the tulip-bulb nature of the technology’s fluctuating stock, Macario seeks to understand how the not-so-abstract value of blockchain can herald something as stable as the second-coming of the gold standard.

“It’s just a matter of who’s controlling the data,” he says. “I think eventually it’s going to be the user, and I hope we can do that in the short term. Data will always be the most valuable resource.”