Employers added 257,000 jobs in January continuing a string of solid payroll numbers. Wage gains and a higher employment-population ratio are also fueling optimism for the year ahead.

“This is a good news report,” says Tara Sinclair, economics professor at George Washington University and chief economist at job search site Indeed.com. “Employers are creating jobs. Workers are finding jobs and people are coming back into the labor force to look for jobs. This is what we would like to see month over month.”

The payroll figure, released by the Bureau of Labor Statistic Friday, was somewhat stronger than economists’ forecast for 235,000 job gains. The unemployment rate, which is drawn from a different survey of households, moved lower to 5.7% from last month’s 5.6% but Sinclair argues this is for the right reasons. People are coming back into the labor force and looking for jobs. “Their first stop is looking, but they haven’t found one yet,” she says.

Michael Arone, an investment strategist for State Street Global Advisors, pointed out that 703,000 people came back into the workforce last month. “Clearly we can’t put them all back to work right away,” he said, but views this as a sign of household confidence. Other data supports this view.

The labor force participation rate rose from 62.7% to 62.9% giving back losses in the prior month. The employment-population ratio was 59.3% up from 59.2% in December and 58.8% a year ago. The length of the workweek was unchanged from December at 34.6 hours. In January average hourly earnings increased by 12 cents to $24.75 from $24.57 a month earlier. This was the biggest monthly increase since November 2008. The year-over-year hourly wage growth rate is now 2.2%.

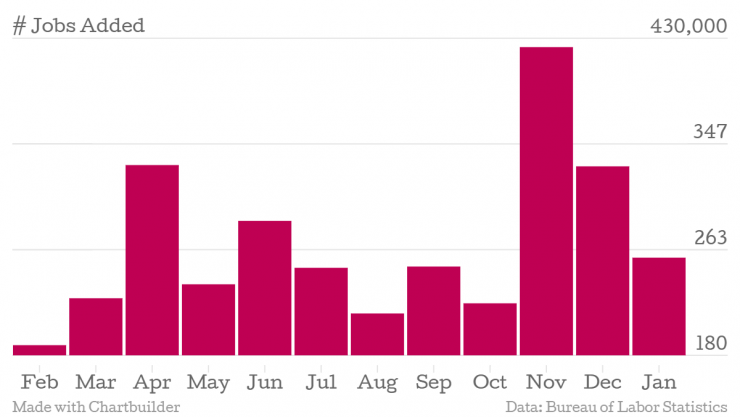

Even stronger than the January figures, though, were the revisions to the final months of 2014. The December payroll count was revised sharply higher to 329,000 after initially coming in at 252,000. The November figure was also bumped even more significantly from plus 353,000 to plus 423,000. Total employment gains in November and December of last year were therefore 147,000 higher than BLS — a division of the Department of Labor — previously reported. Monthly gains averaged 336,000 over the past three months totaling over 1 million jobs and marking the strongest three month gain since 1997.

Sinclair says, “This is not just good news for those individuals who were employed but not being counted properly. When we regularly see upward revisions it means an upward trajectory generally.”

Arone noted another good sign is that job gains have been broad based across recent months. In January, jobs were added in retail trade, construction, health care, financial activities, and manufacturing with half the gains coming from the three biggest gainers. The biggest hiring industry was retail trade with 46,000 jobs added, next were construction and health care with 39,000 and 38,000 jobs added respectively. Employment in industries such as mining and logging, wholesale trade, transportation and warehousing, information and government were little change over the month.

“Taken alone, today’s report will nudge the markets in the direction of a Fed rate hike sooner rather than later,” wrote Jim Baird, chief investment officer at Plante Moran Financial Advisors, in a note on the report. “Inflation certainly remains sedate, but the strength of job creation in recent months seems likely to keep the Fed on the path toward tightening this year.”

Arone views this as “a no surprise report” for the Fed, meaning it will neither cause the central bank to bump up its rate hike timetable nor delay it. The Fed, he says, has been clear it plans to remain accommodative by historical standards even after hitting its full employment target and starting to raise rates. This combined with policy easing from 16 other central banks so far this year will mean significant liquidity for the foreseeable future. According to Arone, the solid U.S. economy, reinforced by reports like this, will make American equities a beneficiary of this trend.

The S&P 500, The Dow Jones Industrial Average and Nasdaq Composite moved further into positive territory following the report. The dollar was also stronger in morning trading and the yield on ten year Treasury notes was up.

This article was written by Samantha Sharf from Forbes and was legally licensed through the NewsCred publisher network. SmartRecruiters is the hiring success platform to find and hire great people.